|

Contents

1. Understanding

the Venture Financing Chain

Venture

Financing Chain

Case in

Point: A Financial Chronology of Amazon.com

Start-Up

Capital Formation Process

Providers

of Finance Throughout the Evolution of an Entrepreneurial Firm

The Equity

Gap

Pre-IPO

Company Ownership (Examples)

Start-Up

Business Success: 10 Steps

Realization of Financial Returns for VC Investor and Exit Strategies

2. Venture

Capital Basics

Selecting

Type of Finance: Debt of Equity?

Specific Features of the Venture Capital

Language

of the Venture Capital

Venture

Capital Funding Stages

Main

Sources of Funds for Entrepreneurial Firms

Distribution of Venture Capitalist Exit Routes and Realized Gains

3.

Understanding Venture Capital Investors

Differences Between Business Angels and Venture Capital Firms

Who

Are Business Angels

Samples of Successful Business Angel Deals

Typical Angel Investments

The

Pros and Cons of Business Angel Investments

Involvement of Business Angels in the Venture

VC-funded High-tech Start-ups: Probability of Success

Characteristics of VC Firms Most Important to Entrepreneurs

Growing Corporate Venture Investing

Dealing With Banks

4.

Introducing Venture Opportunity To Investors

Venture

Capitalists at the First Round Seek...

Key

Documentation To Be Prepared By the Entrepreneur

See

the slide

How To

Introduce Your Opportunity To a Venture Capital Company

Milestone-based Operations and Funding

Outline

for Presentation to Investors

Start-Up

Business Plan

Business

Plan Review by VC Investors

5.

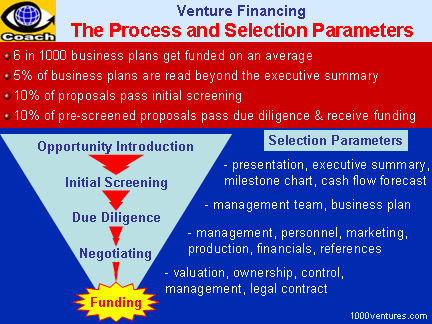

Opportunity Evaluation By Investors

The

Process and Success Rates

Specific

Characteristics of Young Firms: an Investor's View

10 Most

Important Investment Criteria

Aspects

Leading to Rejecting an Investment Opportunity

What VC

Firms Look For In a Business Plan

Due

Diligence: Study Areas

Factors

That Are Analyzed and Verified During Due Diligence

6. Negotiating and Structuring the Deal

Required

Rate of Return for Different Business Stages

Ownership

Required To Support a 30% Return

Valuating

a Start-Up Company: 9 Typical Ways

Negotiations: Value Claiming vs. Value Creation

8 Key

Elements of a Great Deal

Characteristics of Sensible Deals |