|

By:

Osnabrugge, M.V. and Robinson R.J., authors of

Angel Investing

|

-

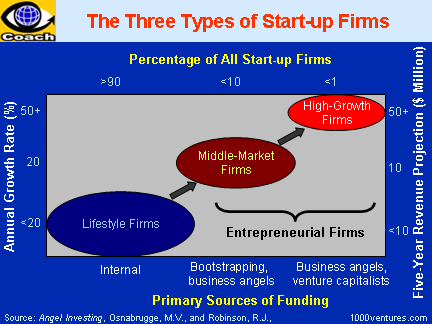

Lifestyle firms are those ventures that provide

only a reasonable living for their founders, rather than

incurring the risks that come with prospects of high growth.

These companies have five-year revenue projections under $10

million and are the classic small businesses. Constituting

more than 90% of all start-ups, it is unlikely that these

firms will attract equity funding from venture capital

investors; instead they have to rely on internal funds.

-

Middle-market firms have growth prospects of more

than 20% annually and five-year revenue projections between

$10 and $50 million. These firms are attractive to

venture capital investors, but they also depend heavily

on bootstrapping to fund initial growth.

-

High-potential firms are those with a

vision for growth that are also

innovative, risk-taking and able to change. They

typically plan to grow into a substantial firm with 50 or

more employees within 5 to 10 years, have five-year revenue

projections in exceed of $50 million, and anticipate annual

growth rates in excess of 50%. These “big-time winning”

firms are often the primary recipients of several rounds of

external

equity finance, early on from

business

angels and later from

venture capitalists. Making up less than 1% of all

start-ups, these firms are among the

Microsofts,

Googles,

Disneys,

Dell Computers of the next millennium.

The last two growth categories

offer the greatest economic contribution of all the firm types;

some economists believe that national economic development

depends on a country’s ability to spawn a lot of high-growth,

entrepreneurial firms.

|

|