| |

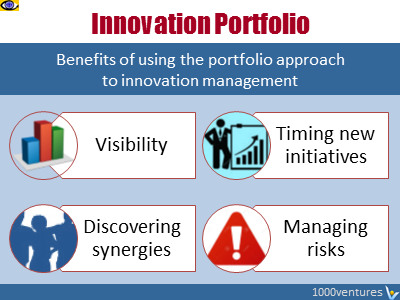

Portfolio is much more than just a list of

initiatives. You should also create charts that compare these initiatives

across dimensions such as stretch, strategic fit, risk, potential return and

resource requirements. |

|

|

| |

|

By using different charts as

lenses to compare initiatives,

you can mix and match

alternatives until you come up

with the portfolio that's the

best for your firm.

|

|

|

|

|

To create a

coherent

innovation portfolio, start by mapping innovations across two dimensions:

product type (existing vs. new) and stage of development (exploration,

development, scaling).

Align each initiative with strategic goals using

data-driven scoring to prioritize high-impact ideas. |

|

| |

Timing of New Initiatives

The innovation portfolio will help you

time when you start a new initiative or transfer a completed one into

manufacturing or the marketplace.

|

|

80/20

Principle

Achieve More with INNOBALL

|

|

|

|

|

3 Primary Criteria to Assess Your Innovation

Portfolio1 |

|

Besides assessing each initiative

individually for risk, investment, return, and timing, assess your

total portfolio to ensure that you have the right initiatives in it:

-

→

Stretch

and strategic fit.

How much does your portfolio push the industry frontiers, and

how well does it fit with your business goals and

strategy?

>>>

-

Capabilities and capacity.

Do you have the required

→

capabilities to

executive the portfolio and do you have enough of them? No

innovation strategy or portfolio is meaningful if don’t possess

the capabilities and capacity to execute it. When the demand for

resources exceeds their supply, a bottleneck forms and work

grinds to a halt. To address this problem,

Silicon Valley firms use two basic approaches: (1) they load

their innovation system to no more than 85% of the actual

capacity, and (2) classify innovation initiatives into broad

categories, determined by size and skill requirement, and then

create templates that summarize the resource and capability

requirements for completing each type.

-

Leverage and risk. Have you

leveraged your investments so that you have a productivity

advantage, while keeping risk within acceptable bounds? Leverage

is what separates winners and losers. You can get leverage, for

instance, from a

platform product, a core product design that

can be tailored with small changes to meet many different

customer applications. Internally, by migrating to a common

platform, you will be able to concentrate employees’ learning on

a single product architecture. The platform approach also

reduces the number of suppliers that you rely upon, increasing

your cost leverage: the same parts can be used repeatedly. The

platform strategy also means that when you undertake a new

derivative, the degree of change is sufficiently small that is

also confines risk and increases reliability.

"Most

→

innovators

are successful to the extent to which they define risks and confine

them."

~

Peter Drucker

|

'

References:

1.

Relentless Growth, Christopher Meyer

2.

"Modern Management", Ninth Edition, Samuel C. Certo

|

Achieving the Right Balance

Between Stretch and Strategic Fit

The first test for any innovation portfolio is

achieving

the right balance between stretch and strategic fit. If you engage in

hyperreactiveness thinking and continually react to the latest market or

technological

trend, rather than following a course until there is a

significant reason to change, you’ll fail. The key to avoiding such

short-term thinking is to maintain

strategic alignment and test the assumptions that drive new products and

service decisions as you make these choices.

>>>

KoRe 10 Innovative

Thinking Tools

The

KoRe 10 Metaphoric Tools

help you

invent new things,

anticipate market shifts and your opponents' moves, find creative

→

solutions

to a complex problem design

a

→

synergistic

innovation

strategy...

More

Silicon

Valley Companies Silicon

Valley Companies

How to decide If your innovation portfolio has

enough stretch? Silicon Valley firms use the following methods...

More

Apple Apple

When Steve Jobs returned to Apple in 1997, he

looked at the number of proposed research and development projects. Then he

stopped most of them. Today, the Apple

brand is known for

its lean

venture strategies, small but value-added product range and

great launch program...

More

Corning Corning

Project selection is a highly

competitive and tightly managed process – not all projects get funded.

For new high-risk and high-potential-return projects, project teams work

hard to find opportunities for lowering costs and reducing risks.

CEO

and the corporate

executive

team formally review individual projects three times a year, making

decisions about the portfolio...

More |

|

|